😲 WARNING: The Tax Code Is Changing 😲

Get Exclusive Access To

The Simplified Tax System

Get Access To This Exclusive Offer for Only $4997

For A Limited Time Only

Get Access To This Exclusive Offer for Only $297

The wealthy top 1% use the Tax Code to pay $0 in taxes. They do this by employing tax strategies that many of us (CPA’s included) have never heard of. That is why I put together this course for you. In this course you will learn how to leverage your: Business Entity, Retirement Plans Children Real Estate & More to significantly reduce your tax liability

Get Access To This Exclusive Offer

for Only $297

Option 2: No, I want to stay uneducated.

Get Exclusive Access To The Simplified Tax System

Get Access To This Exclusive Offer for Only $4997

For a limited time only:

The wealthy top 1% use the Tax Code to pay $0 in taxes. They do this by employing tax strategies that many of us (CPA’s included) have never heard of. That is why I put together this course for you. In this course you will learn how to leverage your:

Business Entity

Retirement Plans

Real Estate

Meals

Travel

Daily Business Expenses

& More to significantly reduce your tax liability

Option 2: No, I want to stay uneducated

This Course Contains Over $250,000

In Tax Saving Strategies

Option 2: No, I want to stay uneducated

Option 2: No, I want to stay uneducated

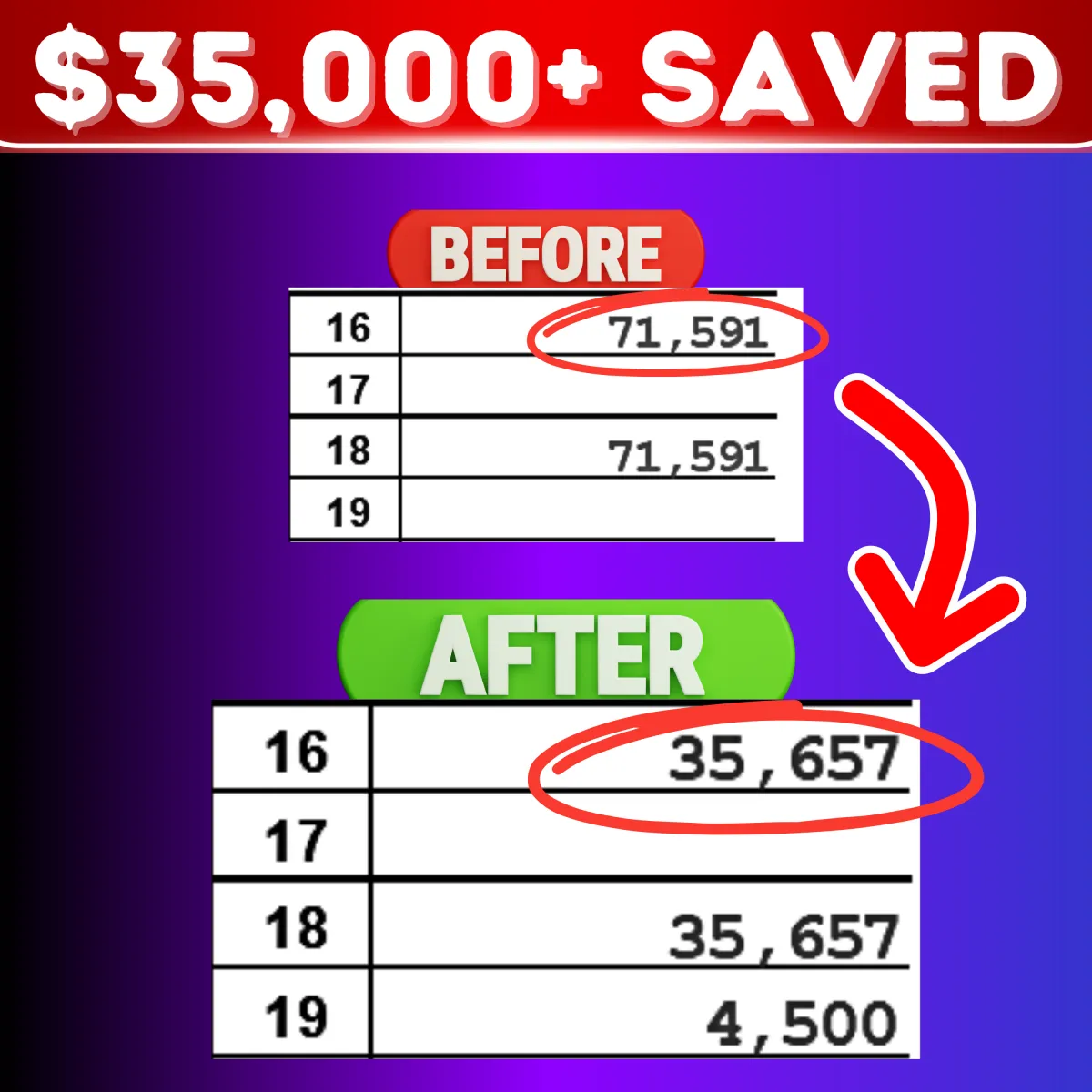

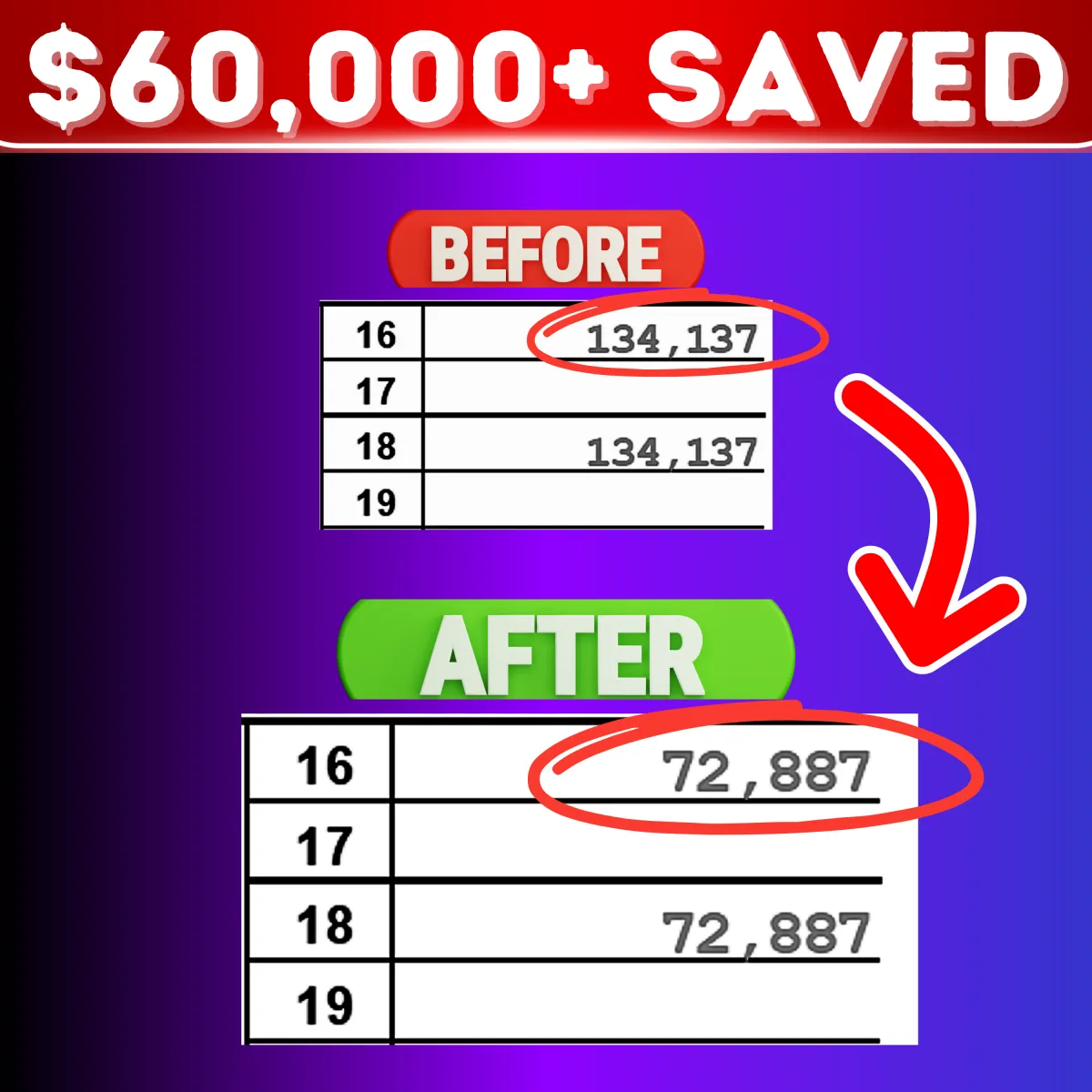

But Don’t Just Take My Word For It…

The proof is in the pudding 🍮

Below are the results my students got after learning The Simplified Tax System.

But Hurry - This EXCLUSIVE Price

Won't Last For Long!

Option 2: No, I want to stay uneducated

Option 2: No, I want to stay uneducated

At this point, you are probably wondering...

Who Is Coach Vee &

How Can She Help Me?

Hi, I Am Verline Wadsworth

(Coach Vee if you're nasty 😂 lol)

I am a Tax Advisor and I help my clients navigate the Tax Code to identify tax strategies that not only save them thousands of dollars each and every year but also sets them to build true generational wealth.

However, prior to this, I was a very uneducated taxpayer and people were taking full advantage of me in this tax space.

I could not defend myself because I did not have the understanding or the knowledge about taxes to position myself to fight back.

This was costing me thousands of dollars each year, not only in loss revenue but also in lost of opportunities such as getting funding to grow out my rental portfolio.

I had a CPA, her name was Mary. I blindly trusted Mary because she had been in the tax and accounting industry for 30+ years. I paid Mary well because I thought she had my best interest at heart.

Mary handed me a Big Fat Tax Bill of $76,000.

Mary offered me NO Strategies,

Mary offered me NO Insight,

Mary offered me NO Feedback on how to lower my tax bill.

Although, I want to continue to blame Mary because she was LAME. I realize that I can take that same energy and help thousands of taxpayers to avoid this same painful situation.

Well, here it is my friend, I am on a mission to educate you so that you are armed with this powerful information. The value is out of this world because you will be able to:

File Your Own Taxes

Fire Your CPA

Educate Your Family

Maybe Even Start Your Very Own Tax Business!!!

Join me NOW!!! and when you do join our private community group and be sure to drop the hashtag #Marysucks

At this point, you are probably wondering...

Who Is Coach Vee &

How Can She Help Me?

Hi, I Am

Verline Wadsworth !

(Coach Vee if you're nasty 😂 lol)

I am a Tax Advisor and I help my clients navigate the Tax Code to identify tax strategies that not only save them thousands of dollars each and every year but also sets them to build true generational wealth.

However, prior to this, I was a very uneducated taxpayer and people were taking full advantage of me in this tax space.

I could not defend myself because I did not have the understanding or the knowledge about taxes to position myself to fight back.

This was costing me thousands of dollars each year, not only in loss revenue but also in lost of opportunities such as getting funding to grow out my rental portfolio.

I had a CPA, her name was Mary. I blindly trusted Mary because she had been in the tax and accounting industry for 30+ years. I paid Mary well because I thought she had my best interest at heart.

Mary handed me a Big Fat Tax Bill of $76,000.

Mary offered me NO Strategies,

Mary offered me NO Insight,

Mary offered me NO Feedback on how to lower my tax bill.

Although, I want to continue to blame Mary because she was LAME. I realize that I can take that same energy and help thousands of taxpayers to avoid this same painful situation.

Well, here it is my friend, I am on a mission to educate you so that you are armed with this powerful information. The value is out of this world because you will be able to:

File Your Own Taxes

Fire Your CPA

Educate Your Family

Maybe Even Start Your Very Own Tax Business!!!

Join me NOW!!! and when you do join our private community group and be sure to drop the hashtag #Marysucks

Once You Join The Simplified Tax System

Get Ready To Discover

Module 1 (Mindset): Mindset Of A Wealthy Taxpayer

You will learn the thought processes of thinking like the wealthy. You will learn how to structure your day to day lifestyle in a way that will allow you to write off almost anything! It is time for you to remove your blinders and start thinking like the wealthy. They know exactly how to not leave any money on the table for Uncle Sam and now you will know what they know.

Module 2 (Assess Your Potential): How To Read Your Return

You will learn exactly how to read your own personal tax return like a pro. Your friends are family will think that you are the go to expert when it comes to taxes. You will learn to quickly breeze through any tax return fully understanding the forms and intricate details.

Module 3 (Learn The Rules): How To Become Audit Proof

You will learn what to look for on a tax return that would indicate high risk for audit. You will gain the confidence needed navigate your way around a tax return while avoiding the pitfalls that could trigger an unnecessary audit.

Module 4 (Run The Play): $250k Worth Of Tax Strategies

You will learn how vast the US Tax Code is and gather a complete understanding of all of the many strategies that you can use to offset your tax liability. There is LITERALLY no need to try to circumvent the system and set yourself up to get audited. There are tons of strategies for you to use LEGALLY!

⭐BONUS: Big Book Of Tax Strategies

This book will open your eyes to the hundreds of strategies that are available to you as a US Taxpayer. Although, you may not immediately qualify for each and every strategy- you will learn how to adjust your day to day activities to match up with the requirements of the strategies. The tax system is a game that you must play so you may as well play to WIN!

⭐BONUS: Guide To Starting A Business

Wow, you are going to blown away by the detailed information that you will have at your finger tips. People pay thousands of dollars for this information to start and launch their businesses. This section will guide you step by step on how to properly set up and form your business from scratch. Having a fully formed and functioning business positions you to obtain thousands of dollars in capital funding.

⭐BONUS: Business Entity Selection Demystified

You will learn all about each entity, in detail. There will be no more guessing when it comes to what entity you should be selecting (Sole Prop, LLC, LLP, S-Corp, C-Corp). You will have the knowledge needed to set your business up properly from the beginning.

⭐BONUS: Retirement Planning For The Self Employed

You will learn all about the healthcare plans and retirement plans that you can use that are tax deductible, such as the HSA, FSA health plans. You will be blown away once you are introduced to all the possibilities that are available to you!

Option 2: No, I want to stay uneducated

But Wait, There's More...

For A Limited Time Only Get

A Personalized Mini Tax Plan

In addition to the Simplified Tax System Course and its bonuses, for a limited time, we are offering a Personalized Mini Tax Plan from me. This means I will personally evaluate your current tax situation and goals, and provide you with an actionable plan on how to achieve those goals while assuring you maximize every tax deduction you are entitled to!

Here's How It Works:

Fill Out Our Quick Fact-Finding Questionnaire:

Complete our brief questionnaire to provide us with the necessary information about your current tax situation and goals.

We Evaluate Your Form, Goals, & The Tax Code:

Our team will thoroughly review the information you provided in the questionnaire. We will analyze your unique circumstances and identify the deductions you qualify for based on the current tax code.

We provide you with a personalized mini tax plan:

Based on our evaluation, we will create a customized mini tax plan specifically for you. This plan will include actionable steps that you can start implementing immediately, allowing you to apply the knowledge you gained from the Simplified Tax System Course to your own situation.

Here's How It Works:

Fill Out Our Quick Fact-Finding Questionnaire:

Complete our brief questionnaire to provide us with the necessary information about your current tax situation and goals.

We Evaluate Your Form, Goals, & The Tax Code:

Our team will thoroughly review the information you provided in the questionnaire. We will analyze your unique circumstances and identify the deductions you qualify for based on the current tax code.

We provide you with a personalized mini tax plan:

Based on our evaluation, we will create a customized mini tax plan specifically for you. This plan will include actionable steps that you can start implementing immediately, allowing you to apply the knowledge you gained from the Simplified Tax System Course to your own situation.

But Hurry - This EXCLUSIVE Bonus

Won't Last For Long!

Option 2: No, I want to stay uneducated

Option 2: No, I want to stay uneducated

An Explosion of Value

Recap Of All You'll Get

T.S.T. System

The Simplified

Tax System

Instant Access To Our Video Course With Over 30 Trainings ($4997 Value)

Guide To Starting A Bullet Proof Business ($2497 Value)

Big Book Of Tax Strategies ($997 Value)

Advanced Tax Strategy Video Training ($2500 Value)

Bonus Personalized Mini Tax Plan From ME 😀

($12,500 Value)

Total Value: $24,991

Get Instant Access Today For Only

Enter Your Details Below

To Gain Instant Access

Your Discount Has Been Applied

I agree to the terms and conditions

🔒We securely process payments with 256-bit security encryption

Your Discount Has Been Applied

🔒We securely process payments with 256-bit security encryption

An Explosion of Value

Recap Of All

You'll Get

T.S.T. System

The Simplified

Tax System

Instant Access To Our Simplified Tax System Video Course With Over 30 Trainings ($4997 Value)

Guide To Starting A Bullet Proof Business Video Trainings ($2497 Value)

Advanced Tax Strategy Video Trainings ($2,500 Value)

Big Book Of Tax Strategies

($997 Value)

Bonus Personalized Mini Tax Plan From ME 😀

($12,500 Value)

Total Value: $24,991

Get Instant Access Today For Only

Your Discount Has Been Applied

🔒We securely process payments with 256-bit security encryption

Enter Your Details Below

To Gain Instant Access

Your Discount Has Been Applied

🔒We securely process payments with 256-bit security encryption

What You Can Expect:

After Taking This Course You Will Know Exactly How To:

How To Read Your Return:

It's YOUR tax return and we teach YOU how to read & understand it with ease!

Become Audit Proof:

There is no need to fear the IRS! Learn how to drastically reduce your tax liability Legally & Ethically.

How to Evolve From Taxpayer to Tax Master:

Learn how to take control, minimize your liability, and keep more of your hard-earned profits

How To Structure Your Business Entity:

Learn how to properly structure your business entity to ensure you are saving the most in taxes!

How To Structure Your Tax Return:

Learn how to structure your tax return to maximize your deductions to keep the money you made!

There Is Only One Thing Left To Do 👇

Unlock Over $250,000 In

Tax Savings!